“The ultimate way to reduce investment risk is to invest in growth over the long run.”

Over 30 years ago, as I embarked on my career as a portfolio manager, a highly respected industry figure shared this profound insight with me. At first glance, it seemed to challenge the conventional wisdom of risk management, which often emphasizes diversification and correlation to mitigate short-term volatility. However, this perspective resonated deeply, prompting a decades-long exploration into its validity. This article presents the culmination of that journey, offering empirical evidence and strategic insights for investment professionals committed to genuine long-term return-risk optimization—not as a marketing cliché, but as a foundational investment philosophy.

Rethinking Risk Management: Beyond Conventional Wisdom

The Misconception of “Time Diversification”

One of the most misunderstood concepts in investing is “time diversification.” Traditional risk management posits that risk does not diminish over time because volatility increases with the square root of time. If the annual standard deviation of returns is σ, over five years, the total risk becomes σ × √5. This statistical perspective suggests that extending the investment horizon does not reduce risk—a view that can be misleading.

However, this interpretation overlooks the exponential nature of compounded returns. While risk, measured by standard deviation, increases sub-linearly with time, expected returns grow multiplicatively. A one-year return of R becomes R⁵ over five years, assuming reinvestment and compounding.

Sharpe Ratio Dynamics Over Time

The Sharpe Ratio, representing return per unit of risk, behaves differently over extended periods:

- Risk Scaling: Risk increases with the square root of time (σ × √T).

- Return Scaling: Expected returns compound over time (R^T).

- Sharpe Ratio Enhancement: The ratio of return to risk improves over time because returns grow exponentially, while risk grows at a slower, sub-linear rate.

Mathematically, the Sharpe Ratio over time can be approximated as:

This dynamic indicates that the Sharpe Ratio increases disproportionately with time, enhancing the return per unit of risk for long-term investments.

A More Accurate Terminology

Given these dynamics, “time diversification” is a misnomer. A more accurate description is:

“Boosting Return per Risk through Time Horizon Extension.”

Extending the investment horizon doesn’t diversify risk in the traditional sense; instead, it enhances the return relative to risk, especially when investing in quality growth assets.

Empirical Evidence: Long-Term Growth Stocks and Sharpe Ratio Trends

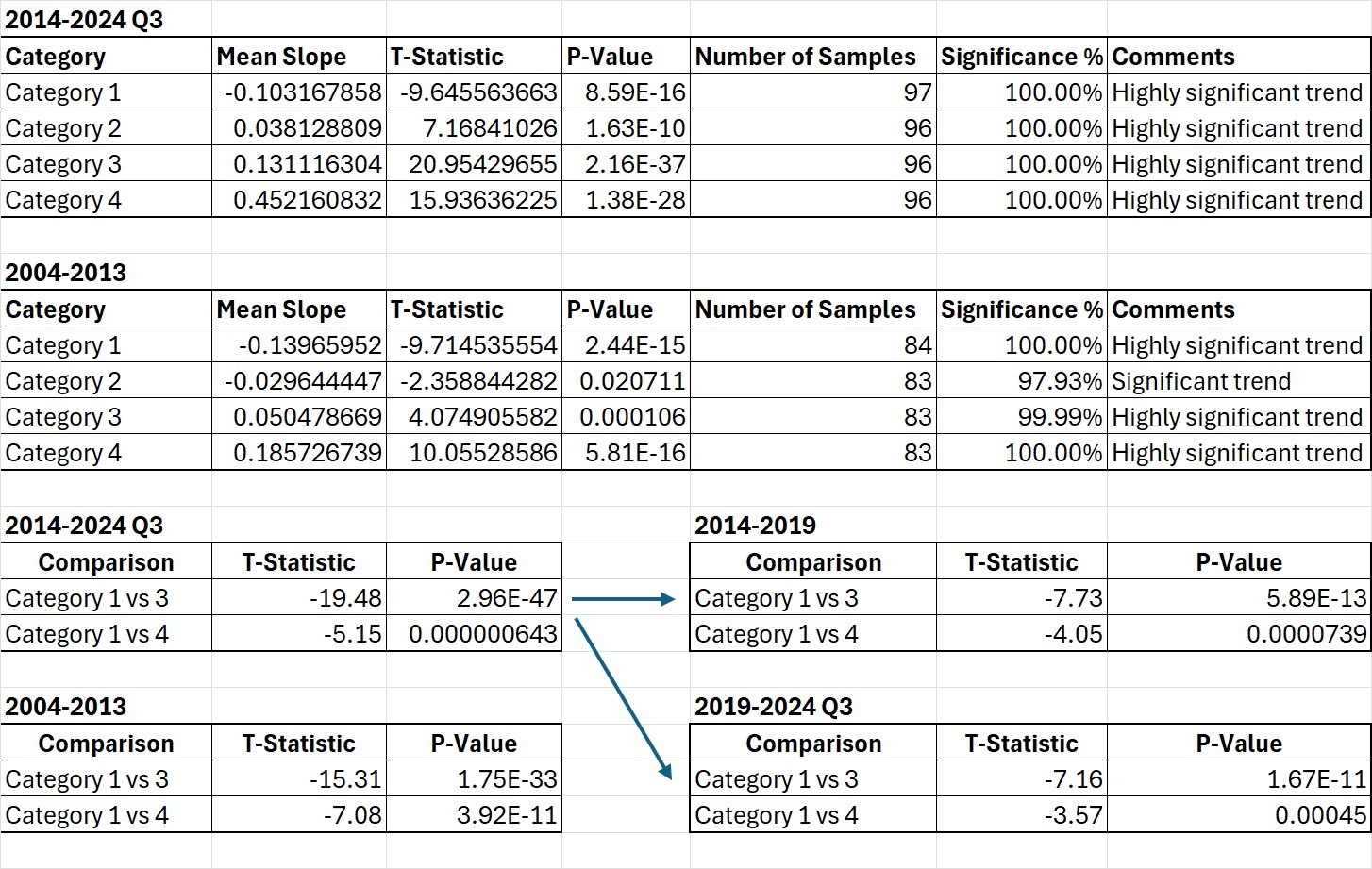

To substantiate this hypothesis, we conducted an empirical analysis of the U.S. stock market, focusing on Sharpe Ratio trends over two decades (2004–2013 and 2014–2024). The goal was to observe how individual stocks’ risk-adjusted returns evolved over time and whether investing in growth stocks over the long term indeed leads to superior outcomes.

Methodology Overview

Data Collection and Cleansing

- Data Sources: Collected historical price data for a broad set of U.S. equities.

- Sharpe Ratio Calculation: Calculated annual Sharpe Ratios for each stock over the specified periods.

- Data Cleansing: Removed outlier (one stock from each period, outlier as risk-adjusted performance too high) with incomplete data to ensure robustness.

Categorization of Stocks

Stocks were divided into four categories based on the quartiles of their Sharpe Ratio changes over each decade:

- Category 1: Lowest quartile (stocks with declining Sharpe Ratios)

- Category 2: Second quartile

- Category 3: Third quartile

- Category 4: Highest quartile (stocks with improving Sharpe Ratios)

Statistical Analysis

- Trend Analysis: Applied linear regression to determine the slope of Sharpe Ratio trends for each stock.

- Hypothesis Testing: Used T-tests to assess the statistical significance of trends within and between categories.

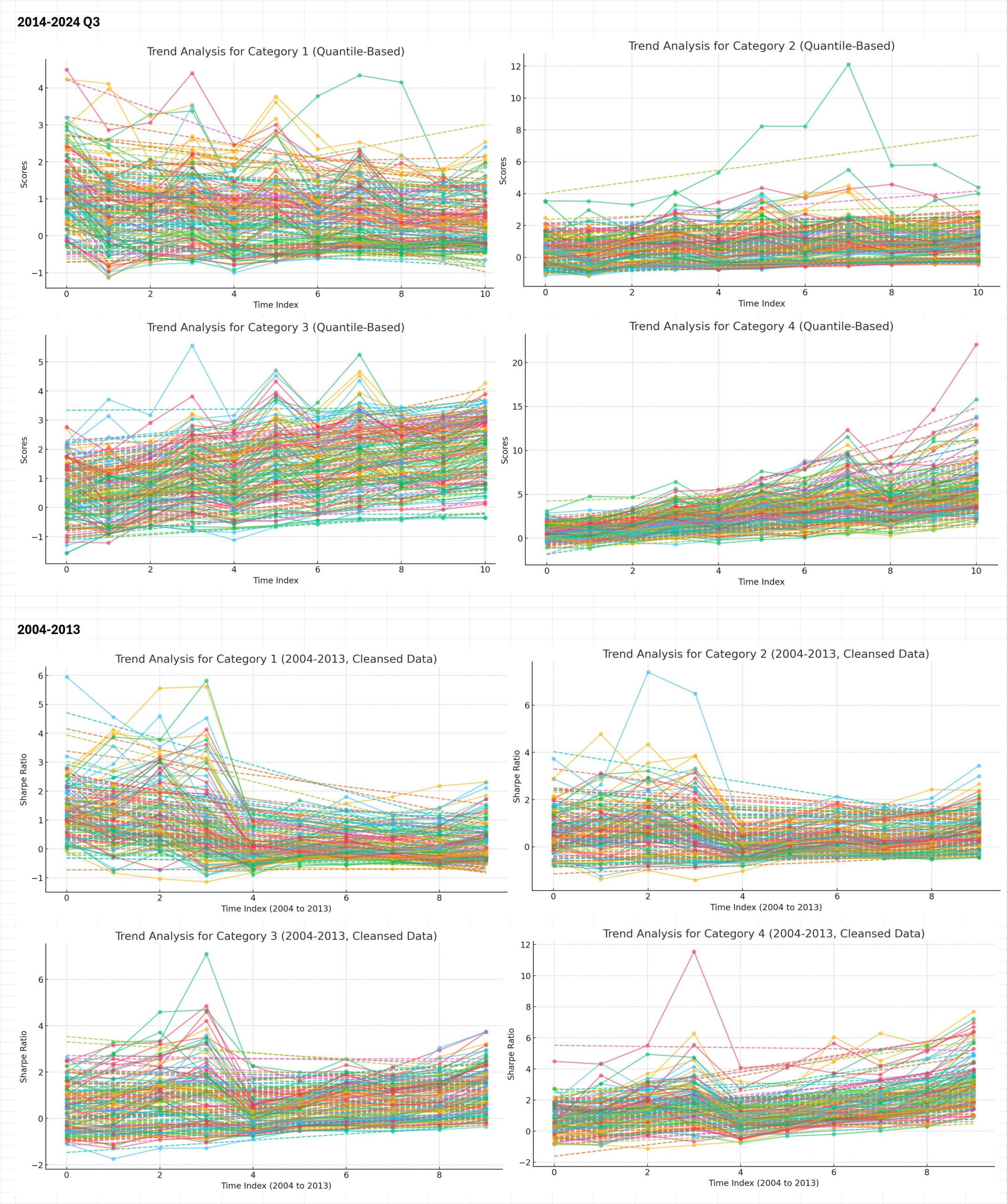

- Visualization: Created time-series graphs and charts to illustrate trends and differences between categories.

Key Findings

1. Positive Trends in Higher Quartiles

Categories 3 and 4 stocks showed significant positive trends in Sharpe Ratios across both decades. The positive trends were highly significant (P-values < 0.001), indicating a robust enhancement of risk-adjusted returns over time. Even during challenging market conditions, these stocks maintained or improved their Sharpe Ratios, underscoring the potential benefits of a long-term return-risk optimization process.

2. Negative or Neutral Trends in Lower Quartiles

Category 1 stocks exhibited negative trends, particularly in the 2004–2013 decade, indicating deteriorating risk-adjusted performance. Although there was a slight positive shift in the 2019–2024 period, it remained significantly lower than the higher categories. This suggests that not all stocks benefit equally from extended investment horizons, highlighting the importance of quality selection.

3. Statistical Significance Between Categories

The differences in Sharpe Ratio trends between Category 1 and Categories 3 and 4 were statistically significant (T-statistics > 7, P-values < 0.0001). This underscores the importance of stock selection and the potential benefits of focusing on high-quality growth stocks for long-term investment.

Visual Insights

Time-series graphs illustrated the divergence in performance between categories over time. Average trend slopes for each category highlighted the superior performance of higher categories, reinforcing the empirical evidence supporting a long-term return-risk optimization process.

The Philosophical Divide: Structural Conflicts in Risk Optimization

A fundamental divide exists in the professional investment world between traditional short-term return-risk optimization processes and long-term return-risk optimization strategies. Understanding this divide is crucial for investment professionals seeking to align their practices with long-term wealth creation.

Traditional Short-Term Return-Risk Optimization Process

This approach focuses on minimizing short-term price fluctuations through diversification based on asset correlations. Utilizing covariance matrices and optimization algorithms, portfolios are constructed to control the portfolio’s net asset value (NAV) variance over relatively short periods. This strategy is deeply embedded in institutional risk management practices and investment guidelines.

While this method offers ease of implementation and effective short-term risk control, it often leads to high turnover, increased transaction costs, and tax inefficiency. More critically, it may dilute exposure to high-growth assets, potentially lowering long-term returns. The short-term focus may conflict with the objective of maximizing long-term wealth, creating a structural misalignment with the end goals of asset owners.

Long-Term Return-Risk Optimization Process

In contrast, the long-term return-risk optimization process prioritizes investing in high-quality growth companies with sustainable competitive advantages. This approach embraces short-term volatility as a necessary trade-off for achieving superior long-term gains. It aligns investment practices with the fundamental objectives of wealth accumulation and capital appreciation over extended periods.

This strategy offers several advantages, including enhanced risk-adjusted returns over time, tax efficiency due to low turnover, and reduced trading costs. However, it requires rigorous analysis to identify suitable growth stocks and demands behavioral resilience to maintain conviction during market volatility. Investors must be willing to tolerate higher short-term volatility without deviating from the long-term strategy.

Structural Conflict Between the Two Approaches

The divergence between these two processes is not merely a matter of strategy but reflects a structural conflict in objectives and implementation. Traditional short-term optimization seeks to minimize immediate volatility, often at the expense of long-term growth potential. In contrast, long-term optimization accepts short-term fluctuations to maximize long-term wealth creation.

Attempting to optimize both short-term and long-term return-risk objectives simultaneously is not feasible due to their conflicting nature. Dual-target optimization can lead to inconsistent portfolio management, introducing unpredictable downsides. Moving between these approaches without a clear strategic framework may result in suboptimal decisions, eroding the benefits of either strategy.

For instance, a portfolio manager might reduce exposure to high-growth stocks during periods of short-term volatility to control NAV fluctuations. This action, while aligning with short-term risk objectives, may undermine the long-term growth potential of the portfolio. Conversely, maintaining high-growth positions without regard for short-term volatility might breach institutional risk guidelines, creating operational challenges.

The key issue lies in the time horizon of risk assessment. Short-term optimization focuses on immediate price variability, while long-term optimization centers on maximizing compounded returns over extended periods. The conflicting objectives make it challenging to integrate these strategies effectively.

Navigating the Structural Conflict: A Strategic Approach

To address this conflict, investment professionals need to make deliberate choices aligned with their clients’ objectives and risk tolerance. Recognizing that dual-target optimization is impractical, the focus should shift towards a coherent strategy that prioritizes long-term wealth creation while managing acceptable levels of short-term risk.

Aligning Investment Policies with Long-Term Goals

Investment policies and guidelines should reflect a clear commitment to long-term return-risk optimization. This involves:

- Defining Clear Objectives: Articulating the primary goal of maximizing long-term risk-adjusted returns.

- Adjusting Risk Parameters: Setting risk tolerance levels that accommodate short-term volatility in pursuit of long-term gains.

- Stakeholder Communication: Ensuring that clients understand and are comfortable with the inherent trade-offs of the chosen strategy.

Enhancing Analytical Frameworks

Integrating robust analytical frameworks can help in navigating the structural conflict:

- Advanced Risk Metrics: Utilizing risk measures that capture long-term risk factors rather than focusing solely on short-term volatility.

- Scenario Analysis: Performing stress tests and scenario analyses to understand potential outcomes over various time horizons.

- Continuous Monitoring: Keeping track of portfolio performance relative to long-term objectives, adjusting as necessary based on fundamental changes rather than short-term market movements.

Behavioral Discipline and Organizational Alignment

Maintaining consistency in portfolio management requires discipline and organizational alignment:

- Investment Team Cohesion: Ensuring that all team members are aligned with the long-term strategy and understand the rationale behind it.

- Performance Evaluation: Aligning compensation and evaluation metrics with long-term performance rather than short-term benchmarks.

- Client Education: Providing clients with regular insights into the long-term strategy’s progress, reinforcing the importance of patience and discipline.

Conclusion: Embracing a Coherent Long-Term Strategy

The empirical evidence supports a profound investment truth: “The most effective way to enhance returns relative to risk is to invest in quality growth over the long term.” This revised maxim encapsulates the essence of our analysis, emphasizing not just risk reduction but the optimization of return per unit of risk through sustained investment in growth assets.

However, the structural conflict between traditional short-term return-risk optimization and long-term return-risk optimization processes presents significant challenges. Investment professionals must recognize that attempting to balance both approaches simultaneously is impractical and can lead to inconsistent portfolio management with unpredictable downsides.

By acknowledging these conflicts and deliberately focusing on a long-term strategy, investors can align their practices with the fundamental goals of wealth creation and capital appreciation. This involves a transformation in mindset—shifting from a primary concern with short-term volatility to a commitment to long-term value generation.

Implementing a coherent long-term strategy requires:

- Strategic Alignment: Clearly defining investment objectives that prioritize long-term return-risk optimization.

- Robust Analytical Frameworks: Employing advanced risk metrics and continuous monitoring to inform decision-making.

- Behavioral Discipline: Maintaining conviction during periods of market volatility and avoiding reactive short-term adjustments.

Moreover, our empirical findings reveal a clear and statistically significant distinction between short-term and long-term return-risk optimization. This distinction is crucial because it highlights that long-term investment and research are structurally different from merely aggregating a series of short-term investments and analyses. Success in short-term investment strategies does not necessarily translate into expertise in long-term investing, as the dynamics, risk factors, and compounding effects differ fundamentally.

This is why we continue to advocate for a dedicated focus on long-term investment and research. Recognizing and embracing the unique characteristics of long-term return-risk optimization enables investment professionals to make more informed decisions that align with the enduring objectives of clients and stakeholders. By appreciating the structural distinctions, we can avoid the pitfalls of inconsistent portfolio management and instead contribute to lasting wealth creation through a consistent, long-term approach.

In closing, the journey towards effective long-term investing is about more than adopting a new strategy; it’s about embracing a philosophy that values sustained growth and understands the true dynamics of risk and return over time. By focusing on optimizing return per risk through long-term investment in quality growth assets—and by recognizing the distinct nature of long-term investing compared to short-term approaches—we can better navigate the complexities of the financial markets and contribute to a more resilient and prosperous financial system.

References

Time Diversification

- Jones, Charles P., and Wilson, Jack W. “Understanding the Time Diversification Controversy.” Journal of Financial Education, vol. 24, Fall 1998, pp. 1–6.

- Summary: This paper delves into the debate surrounding time diversification, examining arguments on both sides and providing insights into its implications for investors.

- URL: https://www.jstor.org/stable/4191770

- Bianchi, Robert J., Drew, Michael E., and Walk, Adam N. “The Time Diversification Puzzle: A Survey.” Financial Planning Research Journal, vol. 1, no. 1, 2015, pp. 47–62.

- Summary: This survey paper reviews the extensive literature on the time diversification puzzle, highlighting key findings and remaining controversies in the field.

- URL: https://doi.org/10.2478/fprj-2016-0009

- Rekenthaler, John. “An Argument About Time Diversification.” Morningstar, 2016.

- Summary: This article discusses the concept of time diversification in the context of investment planning, presenting arguments for and against its effectiveness.

- URL: https://www.morningstar.com/articles/759881/an-argument-about-time-diversification

- Jaggia, Sanjiv, and Thosar, Satish. “Risk Aversion and the Investment Horizon: A New Perspective on the Time Diversification Debate.” Journal of Personal Finance, vol. 1, no. 3, 2002, pp. 211–215.

- Summary: This paper offers a new perspective on the time diversification debate by examining the role of risk aversion and investment horizons in portfolio selection.

- URL: https://doi.org/10.1207/S15327760JPFM0134_6

- Bianchi, Robert J. “The Time Diversification Puzzle: Why Trustees Should Care.” JASSA: The Finsia Journal of Applied Finance, no. 4, 2013, pp. 20–24.

- Summary: This article discusses the implications of the time diversification puzzle for trustees, emphasizing the importance of investment horizon in fund management.

- URL: https://www.semanticscholar.org/paper/The-Time-Diversification-Puzzle%3A-Why-Trustees-Care-Bianchi/7091566ba9f61cf6e54141e0fb6e149a1ed1e9ec

- Kritzman, Mark. “What Practitioners Need to Know… About Time Diversification.” Financial Analysts Journal, vol. 50, no. 1, 1994, pp. 14–18.

- Summary: This paper critically examines the concept of time diversification and its implications for investment strategies.

- URL: https://www.jstor.org/stable/4479845

- Bodie, Zvi. “On the Risk of Stocks in the Long Run.” Financial Analysts Journal, vol. 51, no. 3, 1995, pp. 18–22.

- Summary: Bodie challenges the notion that stocks become less risky over longer holding periods, offering insights into long-term investment risk.

- URL: https://www.jstor.org/stable/4479970

- Samuelson, Paul A. “Long-Run Risk Tolerance When Equity Returns Are Mean Regressing: Pseudoparadoxes and Vindication of ‘Diversification over Time’.” Economics Letters, vol. 61, no. 1, 1998, pp. 101–105.

- Summary: This paper explores the relationship between time diversification and mean-reverting equity returns.

- URL: https://doi.org/10.1016/S0165-1765(98)00153-4

- Levy, Haim, and Sarnat, Marshall. “Long-Term Risk and Time Diversification.” The Review of Economics and Statistics, vol. 78, no. 2, 1996, pp. 248–250.

- Summary: The authors analyze the impact of time on portfolio risk, discussing whether risk diminishes over longer investment horizons.

- URL: https://www.jstor.org/stable/2109922

Sharpe Ratio

- Sharpe, William F. “The Sharpe Ratio.” The Journal of Portfolio Management, vol. 21, no. 1, 1994, pp. 49–58.

- Summary: The original paper by William Sharpe introducing the Sharpe Ratio as a measure of risk-adjusted return.

- URL: https://doi.org/10.3905/jpm.1994.409501

- Goetzmann, William N., Ingersoll, Jonathan E., Spiegel, Matthew, and Welch, Ivo. “Sharpening Sharpe Ratios.” The American Economic Review, vol. 97, no. 2, 2007, pp. 103–106.

- Summary: This paper revisits the Sharpe Ratio, addressing its limitations and proposing adjustments for more accurate risk assessment.

- URL: https://www.jstor.org/stable/30034473

- Christopherson, Jon A., Carino, David R., and Ferson, Wayne E. Portfolio Performance Measurement and Benchmarking. McGraw-Hill, 2009.

- Summary: A comprehensive guide on performance measurement, including detailed discussions on the Sharpe Ratio and other risk-adjusted return metrics.

- URL: https://www.mhprofessional.com/9780071496659-usa-portfolio-performance-measurement-and-benchmarking-group

Long-Term Risk-Return Portfolio Optimization

- Markowitz, Harry. “Portfolio Selection.” The Journal of Finance, vol. 7, no. 1, 1952, pp. 77–91.

- Summary: The seminal paper introducing Modern Portfolio Theory, laying the groundwork for risk-return optimization.

- URL: https://doi.org/10.2307/2975974

- Campbell, John Y., and Viceira, Luis M. Strategic Asset Allocation: Portfolio Choice for Long-Term Investors. Oxford University Press, 2002.

- Summary: This book delves into optimal portfolio choices for long-term investors, considering changing investment opportunities over time.

- URL: https://global.oup.com/academic/product/strategic-asset-allocation-9780198296942

- Brennan, Michael J., Schwartz, Eduardo S., and Lagnado, Ron. “Strategic Asset Allocation.” Journal of Economic Dynamics and Control, vol. 21, no. 8–9, 1997, pp. 1377–1403.

- Summary: The authors explore dynamic strategies for asset allocation, focusing on long-term investment horizons.

- URL: https://doi.org/10.1016/S0165-1889(97)00044-6

- Ilmanen, Antti. Expected Returns: An Investor’s Guide to Harvesting Market Rewards. Wiley, 2011.

- Summary: A comprehensive resource on understanding expected returns across asset classes, valuable for long-term portfolio optimization.

- URL: https://www.wiley.com/en-us/Expected+Returns%3A+An+Investor%27s+Guide+to+Harvesting+Market+Rewards-p-9780470100593

- Kim, Tong Suk, and Markowitz, Harry M. “Investment Rules, Margin, and Market Volatility.” The Journal of Portfolio Management, vol. 16, no. 1, 1989, pp. 45–52.

- Summary: Discusses investment rules in the context of portfolio optimization, considering market volatility over the long term.

- URL: https://doi.org/10.3905/jpm.1989.409216

- Merton, Robert C. “Optimal Investment Strategies for University Endowment Funds.” In Studies of Supply and Demand in Higher Education, edited by Charles T. Clotfelter and Michael Rothschild, University of Chicago Press, 1993, pp. 211–242.

- Summary: Merton applies long-term portfolio optimization techniques to the management of endowment funds.

- URL: http://www.nber.org/chapters/c6098