Shawn:

Hey Julie, I’ve been looking at how people use Free Cash Flow (FCF) in valuations, especially in Discounted Cash Flow (DCF) models and relative multiples, but I’ve realized something important: it’s not just about the FCF figure itself, it’s really about the quality in free cash flow. What do you think?

Julie:

Absolutely, Shawn. FCF is definitely one of the most reliable metrics for valuation, but like you said, the quality of it can be misleading if you don’t make the proper adjustments. I’ve seen plenty of situations where FCF gets overstated. Two key issues that can really distort the picture are amortization for acquisitions and stock-based compensation (SBC). Have you looked at those closely?

Shawn:

Yes, I have. Let’s start with amortization without cash for acquisitions. It’s a non-cash expense, but it reflects past cash outflows for acquisitions. The problem is, if you just ignore amortization because it’s non-cash, you could overstate FCF, especially for companies that rely heavily on acquisitions for growth. You end up missing the actual capital needed to sustain or grow the business. That leads to companies being overvalued. Does that resonate with what you’ve seen?

Julie:

Exactly. And then there’s SBC, which is a bit trickier. It’s another non-cash expense, but it’s dilutive in the long run. When companies issue stock-based compensation, they increase the number of shares outstanding, diluting existing shareholders. That’s the part a lot of people miss—if you don’t adjust future share counts to account for this dilution, your valuation can be way too high. SBC might not impact cash today, but it sure has an effect on ownership and value over time.

Shawn:

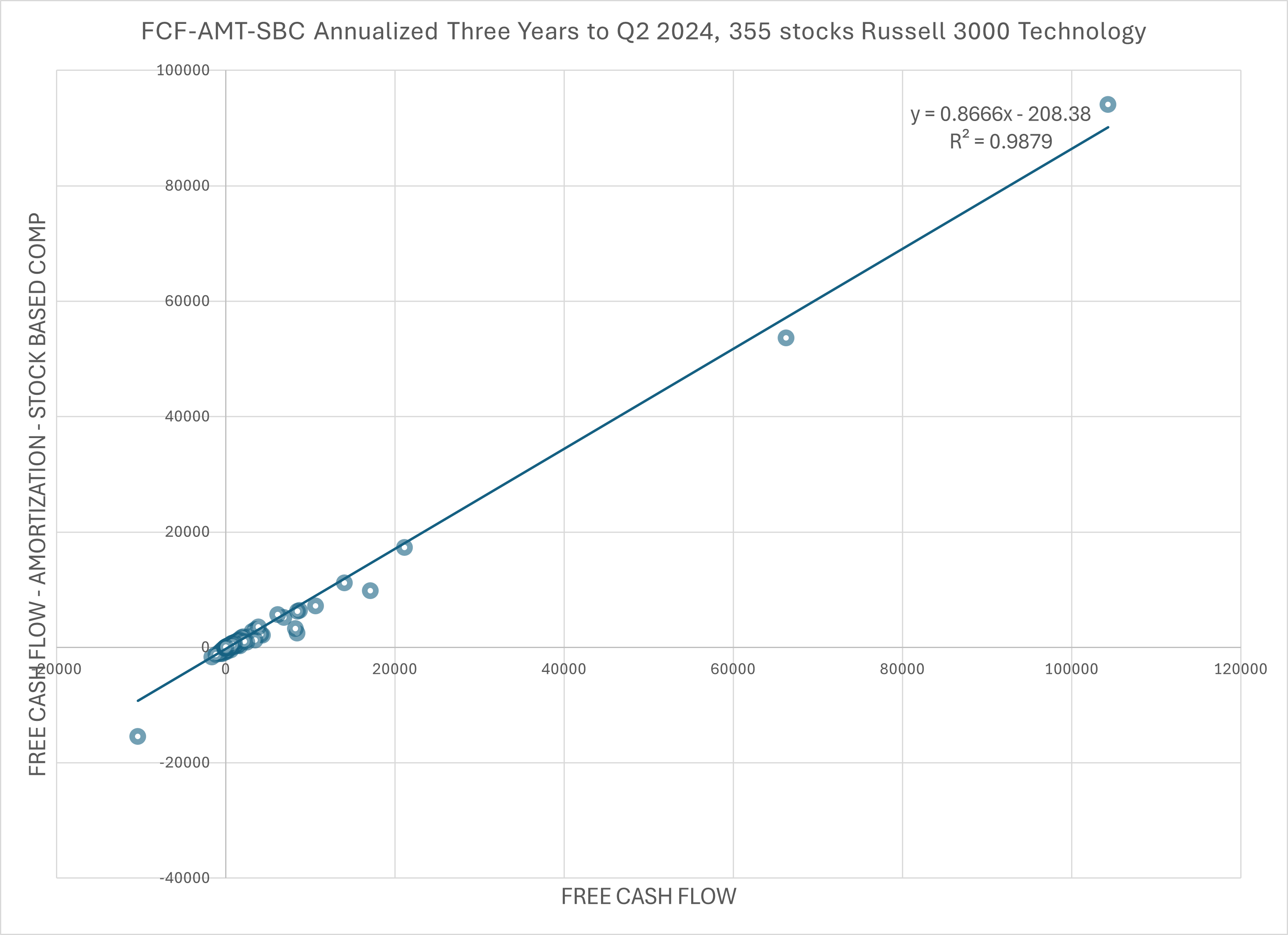

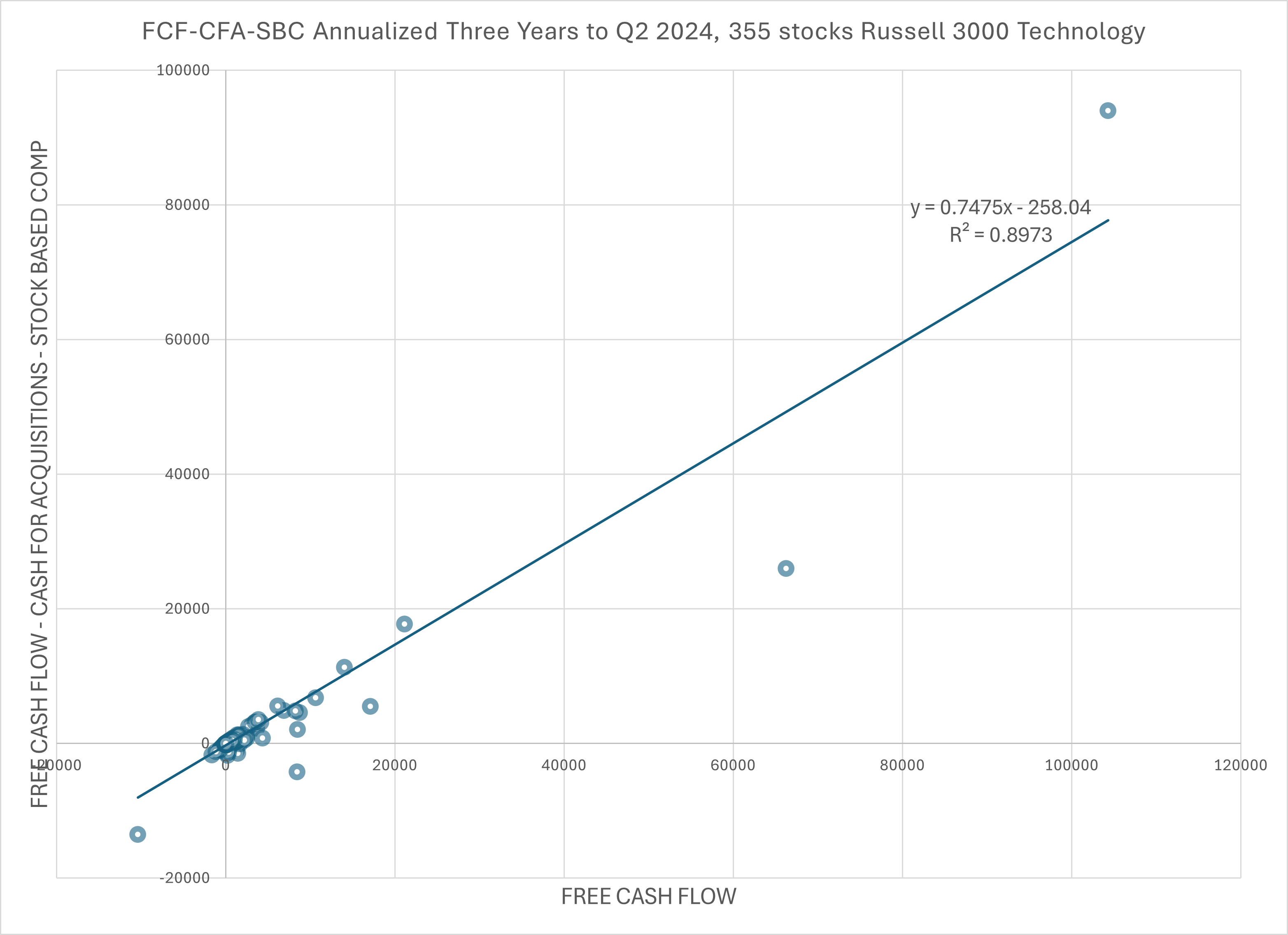

Right, and that’s why we need to look beyond the reported FCF. I was also going through the two adjustment methods for FCF—FCF_CFA_SBC and FCF_AMT_SBC—to see how they reflect the real story. Have you seen the charts for those?

Julie:

Yeah, I’ve looked at them. They tell us a lot. FCF_CFA_SBC, which adjusts for cash outflows related to acquisitions and SBC, gives us a much more conservative view of a company’s true cash flow. It’s a clearer picture of what’s left after significant expenses are deducted. On the other hand, FCF_AMT_SBC adjusts for amortization, following the market convention that ignores the actual cash spent on acquisitions. This can lead to an overstatement of cash flow because it doesn’t show the immediate impact of acquisitions. It’s a bit misleading, don’t you think?

Shawn:

Definitely. What’s even more interesting is that, on average, the actual FCF is overstated by 15-25% using conventional measures like FCF_AMT_SBC. The charts show this clearly. It really drives home the point that you need to factor in the true cash impact of acquisitions and SBC to get a fair evaluation of a company’s financial health.

Julie:

Yes, and another important insight from the charts is that these overstatements aren’t as widely dispersed as some might expect. Most companies fall within a narrower range, which actually makes it easier to spot outliers—those companies where FCF is significantly more inflated than the average.

Shawn:

Exactly. That’s why I think the best approach is to focus on those outliers. These are the companies that are likely using more aggressive accounting practices to make their reported FCF look better than it actually is. By identifying those outliers, we can make more informed investment decisions. What do you think is the best way to approach these outliers?

Julie:

I think you’re right. The key is in the adjustments we make and understanding how these companies report their FCF. But here’s the thing—while we’re digging into the numbers, we also have to acknowledge that market pricing often follows market convention more than it follows the actual fundamental value of a security, right? The market is often pricing assets based on figures like FCF_AMT_SBC, rather than more stringent definitions like FCF_CFA_SBC.

Shawn:

That’s a great point. So even though we know FCF is overstated in some cases, the market might still price these companies based on those conventional figures. That’s where it gets tricky. Do we hold firm to the theoretical valuation, or do we accept that the market is using these figures for pricing?

Julie:

Exactly! In theory, market prices should move dynamically around the intrinsic value, gradually converging toward equilibrium. But in reality, the market is in a constant state of disequilibrium, often influenced by the most widely accepted financial metrics. So stressing too much about the theoretical, strict definitions of FCF might not be the best way to predict short-term market movements.

Shawn:

I agree. That’s why we need to be flexible. Instead of rigidly sticking to definitions, it’s more effective to discount conviction subjectively. I think we should assess how transparent a company is being with its financial management. Are they openly disclosing their acquisition and SBC strategies? Or are they trying to mask what’s really going on by sticking to market convention?

Julie:

Right. Transparency is key. Companies that are upfront about their financial strategies, especially regarding acquisitions and SBC, tend to offer better insights into their long-term cash generation. On the other hand, if a company is using market convention levers to boost its FCF without proper disclosure, that’s a red flag. Investors should be cautious with those companies.

Shawn:

Yes, and that brings us to evaluating growth initiatives. It’s not just about penalizing companies that show inflated FCF—sometimes their growth strategies might actually justify those cash outflows. But it requires a deep, insightful analysis to distinguish between companies inflating their FCF artificially and those with solid growth plans that might temporarily hurt cash flow.

Julie:

Exactly, Shawn. In those cases, it’s more about understanding the effectiveness of their strategic initiatives. If their growth efforts are yielding strong results, we might want to cut them some slack on the cash flow front. But again, it all comes down to transparency and quality of financial management. By identifying and discounting outliers based on these factors, we can align our valuations with long-term fundamentals, while still keeping an eye on short-term market pricing.

Shawn:

Absolutely. So the takeaway here is clear: Focus on outliers, keep an eye on management’s transparency, and be flexible enough to factor in both theoretical valuation and market conventions when making decisions. That way, we can avoid the traps of overstated FCF and make smarter investment moves.