Introduction

Screening has long been a cornerstone of the initial pipeline of invest process, enabling investors to shift through vast datasets to identify potential opportunities based on specific characteristics such as value, momentum, and quality. However, for long-term fundamental investors, integrating these screening processes into their strategies presents unique challenges. The selection and design of screening criteria can either complement or disrupt long-term investment goals. This research explores how to effectively integrate factor-based screening into long-term strategies, addressing concerns such as time horizon misalignment, the necessity of judgment in parameter selection, and the inherent risks associated with factor-driven strategies like value investing.

Recent academic studies have exposed limitations in long-held beliefs about certain factors, particularly the value factor, which is one of the most popular screening parameters. Once considered a reliable driver of outperformance, however, it has persistently underperformed in recent years. This underperformance underscores the importance of contextualizing screening criteria within broader market dynamics and fundamental analysis, rather than relying on simplistic applications of traditional price multiples. We also examine how advanced methodologies, such as machine learning and neural networks, can enhance the robustness of screening tools without undermining long-term investment philosophies.

- Aligning Screening with Investment Focus and Style

Most long-term fundamental investment processes begin with some form of screening, serving as an initial filter to identify potential opportunities. However, a key issue often overlooked is the construction and design of the screening process itself. Many firms focus extensively on subsequent stages—such as detailed fundamental research, valuation, and portfolio management—but pay insufficient attention to how well-designed screening criteria can impact the overall efficacy and coherence of the research process.

A well-constructed screening process is essential to ensuring that the entire research pipeline is productive, coherent, and aligned with the investment philosophy. If the screening methodology does not accurately reflect the firm’s investment style, it can lead to misallocation of time and resources. For example, a screening process heavily weighted toward short-term metrics can generate ideas misaligned with the firm’s long-term focus, forcing analysts to spend time on irrelevant opportunities. Conversely, a properly designed screening process acts as a consistent filter that focuses on ideas aligned with the firm’s strategic objectives.

Key Considerations in Screening Construction:

- Aligning Screening Criteria with Investment Philosophy: Screening criteria should be constructed with a clear understanding of the firm’s investment focus and style. The selection parameters must reflect the long-term vision, ensuring that screened results align with the firm’s research goals.

- Enhancing Research Productivity and Coherence: A thoughtfully designed screening process not only enhances the quality of investment ideas but also ensures consistency across the research team. Clear and aligned screening criteria enable both analysts and portfolio managers to operate with a shared understanding of the types of companies being considered, improving productivity and coherence in decision-making.

In sum, screening is not merely a mechanical starting point—it is a critical component that affects the quality of the entire investment process. By ensuring that the screening phase is properly designed, firms can enhance both the effectiveness and coherence of their research, leading to better alignment between analysts and portfolio managers. The screening process should serve as the foundation for a seamless and efficient pipeline that drives high-quality, long-term investment ideas.

- Small, Concentrated Teams: Focusing on Core Factors

For small investment teams, such as those in hedge funds or boutique firms, the design and focus of screening criteria become even more critical due to resource constraints. While large firms can afford to use broad screening tools covering multiple factors, small teams must concentrate on a select number of factors that best align with their specific investment style and philosophy.

Key Practices for Small Teams:

- Customization and Flexibility: Small teams should employ customized, flexible screening criteria that reflect their long-term strategy. Rather than adopting a broad, generic approach, the team should identify a few core factors that capture their investment edge and focus their research on high-conviction ideas.

- Efficient Screening: The screening process should be efficient, serving as a filter that directs the team’s limited resources toward high-potential ideas. The focus should remain on long-term value creation, avoiding factors that rely heavily on short-term fluctuations or transient market trends.

This approach ensures that limited resources are deployed effectively, identifying candidates more likely to contribute to long-term performance while maintaining focus and reducing unnecessary distractions.

- Challenges in Selecting the Right Parameters for Screening

Selecting the right parameters for a screening process is a critical challenge, particularly for long-term fundamental investors. While factor studies have traditionally focused on short-term price dynamics, parameters used for long-term investing must add value by identifying companies capable of generating sustained returns over an extended period. This contrasts with short-term factors, which may highlight companies experiencing temporary price fluctuations but lack the enduring qualities that long-term investors seek.

a) Long-Term Returns vs. Short-Term Dynamics

Many factor-based models are inherently designed to capture short-term price movements. These models often emphasize recent earnings momentum, short-term volatility, or price-to-earnings ratios that may suggest near-term undervaluation but are not necessarily indicative of long-term potential. For long-term investors, the selected parameters must align with durable, fundamental characteristics that contribute to sustained value creation over years, not months. The goal of screening should be to discover candidates with long-term growth prospects, strong market positions, and the ability to navigate economic cycles—attributes requiring deeper, more thoughtful selection criteria beyond short-term price behavior.

b) The Role of Judgment in Parameter Selection

Determining the right set of parameters is not purely a quantitative exercise; it requires a judgmental process informed by long-term investing experience. Parameters that may seem promising based on historical performance data can lead to false positives if applied naively. Experienced investors understand that evaluating these parameters involves more than optimizing a model; it requires a deep understanding of how different economic environments, industry cycles, and competitive dynamics impact a company’s ability to create value over time.

This judgmental process includes considering factors most relevant to long-term investing, such as competitive advantages or capital allocation discipline, and weighing them against traditional metrics. Without the input of experienced judgment, there is a risk that the screening process will rely too heavily on simplistic quantitative measures, missing the underlying qualities that contribute to a company’s enduring success.

c) Challenges in the Discovery Process: Small Samples and Overfitting

Another significant challenge in identifying and selecting appropriate screening parameters is the discovery process itself, particularly when dealing with historical data. To avoid multicollinearity and overfitting, it’s common practice to eliminate overlapping or redundant data from the dataset. However, this can result in a small sample size issue, especially when the dataset spans decades with fewer comparable companies during certain periods. Smaller samples make it more difficult to draw reliable conclusions, increasing the risk of overfitting—where selected parameters perform well in backtests but fail in real-world application.

Addressing Small Samples: Refining parameters often involves trial and error, where analysts must balance the need for a robust dataset with historical limitations. This makes the discovery phase complex and prone to missteps if not managed carefully. To mitigate these risks, investors need to ensure that parameters are not only statistically sound but also intuitively aligned with long-term investment principles, underscoring the crucial role of experience and judgment.

In summary, selecting the right screening parameters for long-term investing goes beyond mechanical optimization. It requires thoughtful judgment and a deep understanding of what drives long-term value, while navigating the challenges of limited sample sizes and potential overfitting. By addressing these issues, the screening process can effectively contribute to identifying investment candidates with the potential for sustained returns.

- The Diminished Role of the Value Factor: Revisiting Factor Returns in Light of Recent Research

The value factor has long been a cornerstone in factor-based investing, celebrated for its purported ability to identify stocks trading at a discount to their intrinsic value using metrics like price-to-earnings (P/E) and price-to-book (P/B) ratios. For decades, investors have relied on the value factor to screen for undervalued opportunities, expecting these stocks to outperform over time. However, recent underperformance of the value factor suggests that its efficacy may be waning, necessitating a critical reevaluation of its role in modern investment strategies.

Recent academic research, including the paper titled “Equity Factor Timing: A Two-Stage Machine Learning Approach,” provides a detailed examination of the value factor’s declining performance. This research highlights that the underperformance is not merely a temporary anomaly but is rooted in deeper structural elements that render factor premia alone suboptimal without considering shifts in market risk regimes. These findings compel us to reconsider the assumptions underlying value-based screening and question whether the value factor remains an effective tool for identifying undervalued investment opportunities in today’s complex market environment.

a) Statistical Findings vs. Fundamental Undervaluation

One primary conclusion from recent studies is that traditional approaches to the value factor—such as screening for stocks with low P/E or P/B ratios—are predicated on the assumption that these stocks are fundamentally undervalued. However, this assumption often stems from statistical correlations based on historical performance rather than a rigorous assessment of future cash flows or intrinsic value associated with these companies.

The key issue is that low price multiples indicate that the market pricing for these stocks is lower than average, but this does not necessarily equate to fundamental undervaluation. The market price reflects current sentiment and may be influenced by factors unrelated to the company’s long-term prospects. Relying solely on low multiples conflates cheapness with value, potentially leading investors to overlook companies with genuinely strong fundamentals but higher price multiples.

In his 2021 article “Value Investing: Requiem, Rebirth or Reincarnation?”, Professor Aswath Damodaran of NYU Stern School aptly highlights the distinction between market price multiple-derived “value” and “fundamental value” based on future cash flows. He examines the returns of value stocks versus growth stocks from new angles, indicating the overlooked issues when applying the conventional market definition of value—essentially “low market price multiples”—to the actual investment decision process. Damodaran’s insights underscore the pitfalls of relying on simplistic metrics without a deeper analysis of a company’s intrinsic value.

b) Market Risk Regimes and Their Impact on Factor Returns

Another critical aspect of recent research is the role of market risk regimes in shaping the returns of the value factor. Market risk regimes refer to distinct periods characterized by varying levels of volatility, interest rates, and economic growth. These regimes significantly influence the performance of different investment factors, including value.

During periods of high volatility or economic instability, value stocks tend to underperform as investors gravitate toward growth stocks or safer assets. Conversely, value stocks may outperform during stable periods of low volatility and modest economic growth. The challenge lies in the fact that these favorable conditions for value investing have become increasingly infrequent in recent years. The time-varying nature of factor returns implies that the effectiveness of the value factor is conditional upon specific market environments.

There are additional implications from the conditional nature of factor returns on the stock screening process:

- Higher Turnover of Screening Candidates: The reliance on market regimes can lead to a higher turnover of screening candidates due to shifts in market conditions. This increased turnover may not align with the long-term research horizon of fundamental investors, causing a mismatch between screening outputs and investment objectives.

- Uncertainty and Fragility: There is uncertainty and fragility regarding the contribution of each factor and the prevailing market regime. This blurring of factor impacts makes the screening process more influenced by current market prices, which contradicts the foundational principles of fundamental investment processes that focus on intrinsic value rather than market sentiment.

- Challenges in Market Regime Prediction: Predicting and classifying market regimes cannot be done objectively with consistent accuracy. The timeliness and precision required for such predictions are difficult to achieve, potentially rendering the screening process unreliable over time.

An additional point worth noting is the inherently paradoxical objective of applying market regime analysis in conjunction with factor investing. As more investors adopt this approach collectively, it can lead to herding behavior and increased market volatility. This, in turn, affects the classification of market regimes in a self-referential manner, forcing strategies that combine market regime analysis with factor investing to implement additional measures to contain volatility. Essentially, these self-reinforcing chain reactions do not lead to convergence but rather to an expansion of volatility. This outcome is contrary to the original objective of reducing risk and can destabilize the market, undermining the strategy’s intent to mitigate risk.

The uncertainty introduced by the conditional nature of factor returns and the challenges in predicting market regimes make it increasingly difficult to rely on the value factor for consistent outperformance. This raises significant concerns about the usefulness of the value factor in long-term fundamental investing, as its reliance on certain market conditions renders it less predictable over extended periods.

c) Evidence of Suboptimal Factor Returns

Empirical evidence supports the deteriorating performance of the value factor. Both the S&P 500 Value Index and the S&P Small Cap 600 Value Index have significantly underperformed the broader S&P 500 Index, particularly over the past decade. This divergence reflects a broader trend: the value factor’s underperformance is part of a structural shift in market dynamics rather than a temporary deviation.

The chart demonstrates how growth stocks have consistently outperformed value stocks, especially in post-2015 market conditions. This persistent underperformance suggests that the traditional assumption—that value stocks will revert to their mean and deliver superior returns—may no longer hold true. The data underscores the need to rethink the role of the value factor in screening processes and investment strategies, as relying on historical patterns may lead to suboptimal investment outcomes.

d) Structural Shifts Within the Banking Industry

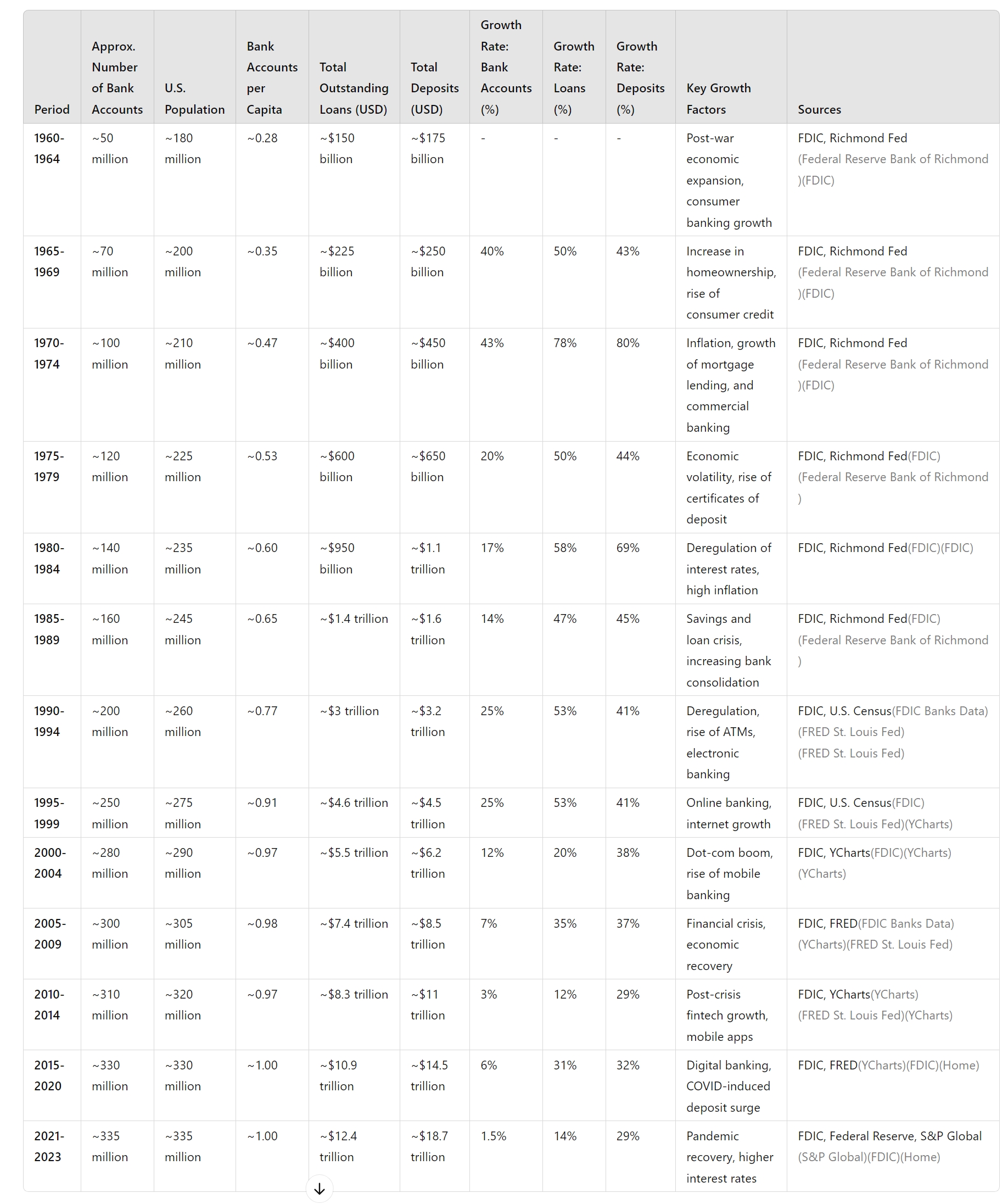

The banking industry, one of the largest sectors consisting value stock indices, serves as a prime example of how an entire sector can transition from being a cyclical value play to a saturated industry, rendering traditional value metrics less relevant. Historical data illustrate the evolution of the banking sector over several decades.

From the 1960s to the 1980s, the banking industry experienced rapid growth driven by rising homeownership, increasing deposits, and a favorable regulatory environment. During this period, value investors could capitalize on the cyclical nature of the sector, as banks were often mispriced during economic downturns but rebounded as conditions improved.

However, starting in the 1990s, the growth rate of banking activity—including loans and deposits—slowed significantly. The industry became saturated, with limited room for further expansion. Growth rates for deposits and loans diminished, and the overall value of the banking industry became less cyclical and more stagnant. This structural shift makes it more challenging for value investors to rely on the banking sector for cyclical mispricings, as opportunities for market reversals have become less frequent and less pronounced.

The shift in the banking industry exemplifies how structural changes within an industry can diminish the efficacy of traditional value metrics. Investors relying on historical patterns without accounting for fundamental changes may find that traditional value strategies no longer yield the expected results.

e) Implications for Screening Processes and Investment Strategies

Given these multifaceted challenges—the statistical shortcomings of traditional value metrics, the conditional nature of factor returns based on market regimes, empirical evidence of underperformance, and structural industry shifts—it is imperative for investors to reassess the role of the value factor in their screening processes.

Rethinking Value Metrics:

Investors should consider moving beyond simplistic price multiples and incorporate more comprehensive measures of intrinsic value. This involves a deeper analysis of a company’s future cash flows, competitive advantages, and growth prospects. By focusing on fundamental value rather than market-derived multiples, investors can better identify companies with genuine long-term potential.

Incorporating Market Dynamics:

While market regime analysis presents challenges, being cognizant of broader economic and market trends can enhance investment decisions. However, investors should be cautious about over-reliance on market regime predictions due to their inherent unpredictability and potential to introduce additional volatility into the investment process.

Avoiding Herding Behavior:

Awareness of the paradoxical effects of widespread adoption of factor investing strategies is crucial. As more investors employ similar strategies, the resultant herding behavior can exacerbate market volatility and undermine the effectiveness of these strategies. Investors should strive for independent analysis and avoid over-dependence on widely adopted factors.

Embracing a Holistic Approach:

A more dynamic and holistic approach to screening and investment strategy is necessary. This includes integrating qualitative assessments, such as management quality and industry positioning, with quantitative analyses. Employing advanced analytical tools, like machine learning and neural networks, can aid in identifying patterns and opportunities that traditional methods may overlook, but these tools should complement, not replace, fundamental analysis.

Conclusion:

The value factor’s historical prominence in investment strategies is being challenged by empirical evidence of underperformance and deeper structural issues. The time-varying nature of factor returns, the unpredictability of market regimes, and structural shifts within industries like banking necessitate a reevaluation of the value factor’s role in modern investment practices.

Investors must recognize the limitations of relying solely on traditional value metrics and consider adopting more nuanced, forward-looking approaches that emphasize intrinsic value based on future cash flows and fundamental analysis. By doing so, they can better navigate the complexities of today’s market environment and improve the alignment of their screening processes with long-term investment objectives.

- Optimizing Parameters Through Machine Learning

While selecting parameters manually relies on judgment and experience, advanced tools like machine learning can significantly enhance the process by dynamically adjusting and refining parameters based on large datasets. Machine learning can help identify patterns and relationships between variables that may not be immediately evident through traditional analysis.

Steps for Machine Learning-Based Screening:

- Discovery Phase: Use a machine learning model to identify broad patterns in historical and real-time data, ensuring that the screening model reflects long-term investment priorities. Maintaining visibility over the model in this early stage is crucial to keep the process transparent.

- Parameter Optimization: After gathering a comprehensive dataset, apply more sophisticated techniques such as grid search and neural networks to refine and optimize the parameters. Allowing these tools to make data-driven refinements makes the model more robust, adapting to changing market conditions and uncovering high-potential opportunities.

- Neural Networks for Dynamic Refinement: Once the dataset is built and key parameters identified, neural networks can continuously adjust the parameters as new data is processed, allowing the screening tool to evolve in response to market dynamics.

Using machine learning in this way ensures that the discovery and optimization phases remain aligned with the firm’s long-term strategy while improving the precision and predictive power of the screening tool.

- Complexities of Layered Approaches

Factor-based screening models often involve multiple layers of complexity, incorporating various factors, historical datasets, and statistical methods. However, increased complexity raises the risk of conflicting signals and overcomplication.

Key Issues:

- Seamlessness: If screening tools are not seamlessly integrated with the firm’s fundamental research, results can become disjointed, leading to an inefficient research process.

- Frequency of Change: Screening models often generate rapidly changing outputs due to short-term market volatility, conflicting with the long-term horizon that fundamental investors need. Screening should be used less frequently in long-term strategies to avoid chasing short-term trends.

- Sector Bias and Short-Term Focus: Many screening models inadvertently introduce sector biases by overweighting sectors that have recently performed well. This focus on near-term factors can cause investors to miss opportunities in underappreciated sectors with better long-term potential.

To address these challenges, the screening process should be kept simple and focused, ensuring it complements fundamental analysis without overwhelming the research team or introducing conflicting signals.

- Neural Networks and Screening for Blind Spots

One of the most valuable applications of neural networks in factor-based screening is their ability to uncover blind spots that may not be visible through traditional research methods. Neural networks, when employed judiciously, can help identify anomalies or patterns requiring further investigation.

Use Case:

- Occasional Screening: Rather than relying on screening models continuously, investors should use neural networks for periodic screening—perhaps quarterly or semi-annually—to highlight areas of the market that may have been overlooked. This occasional use can reveal hidden opportunities without disrupting the firm’s long-term strategy.

- Self-Awareness and Discussion: Neural network-based results should serve as discussion points for the investment team, raising awareness of potential blind spots without dictating decisions. This ensures that the research process remains fundamentally driven while still benefiting from data-driven insights.

By incorporating neural networks into the screening process in a limited and targeted manner, investment teams can raise awareness of potential risks or opportunities that might otherwise go unnoticed.

Conclusion

Integrating factor-based screening into long-term fundamental investment requires careful consideration of the firm’s investment focus, parameter selection, and research methodology. The recent underperformance of the value factor highlights the dangers of relying too heavily on historical factor data or price multiples without incorporating broader market dynamics and fundamental analysis.

Machine learning and neural networks offer promising avenues to optimize parameter selection and identify blind spots in the research process. However, these tools must be used in conjunction with rigorous judgment and long-term thinking to ensure they enhance rather than detract from the fundamental research process. Ultimately, by using factor-based screening as a complementary tool, long-term investors can gain additional insights without compromising their focus on sustainable, high-quality investments.

References

- Bender, J., Sun, X., Thomas, R., & Zdorovtsov, V. (2017). “The Promises and Pitfalls of Factor Timing.” Wharton School. Retrieved from https://jacobslevycenter.wharton.upenn.edu/wp-content/uploads/2017/08/The-Promises-and-Pitfalls-of-Factor-Timing-1.pdf

- Botte, A., & Bao, D. (2021). “A Machine Learning Approach to Regime Modeling.” Two Sigma. Retrieved from https://www.twosigma.com/articles/a-machine-learning-approach-to-regime-modeling/

- Chan, L. K. C., & Lakonishok, J. (2004). “Value and Growth Investing: Review and Update.” Financial Analysts Journal, January/February 2004. Retrieved from https://www.tandfonline.com/doi/abs/10.2469/faj.v60.n1.2593

- Chan, L. K. C., Karceski, J., & Lakonishok, J. (1998). “The Risk and Return from Factors.” Journal of Financial and Quantitative Analysis, 33(2). Retrieved from https://www.jstor.org/stable/2331306

- Chincarini, L. B., & Kim, D. (2022). Quantitative Equity Portfolio Management, Second Edition: An Active Approach to Portfolio Construction and Management. McGraw Hill. Retrieved from https://www.mhprofessional.com/quantitative-equity-portfolio-management-second-edition-an-active-approach-to-portfolio-9781264268924-usa

- Cornell, B., & Damodaran, A. (2021). “Value Investing: Requiem, Rebirth or Reincarnation?” Leonard N. Stern School of Business. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3779481

- Damodaran, A. (2020). “Value Investing II: Time for An Update.” Retrieved from https://pages.stern.nyu.edu/~adamodar/pdfiles/blog/ValueInvesting2.pdf

- DiCiurcio, K. J., Wu, B., Xu, F., Rodemer, S., & Wang, Q. (2023). “Equity Factor Timing: A Two-Stage Machine Learning Approach.” The Journal of Portfolio Management, 50(3), 132. Retrieved from https://www.pm-research.com/content/iijpormgmt/50/3/132

- Handbook of Artificial Intelligence and Big Data Applications in Investments. (2023). CFA Institute Research Foundation. Retrieved from https://rpc.cfainstitute.org/research/foundation/2023/ai-and-big-data-in-investments-handbook

- Huang, S., Song, Y., & Xiang, H. (2023). “The Smart Beta Mirage.” Journal of Financial and Quantitative Analysis. Retrieved from https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/article/smart-beta-mirage/35CA1CEA091A485DDA960BB2D9930BC9

- Ilmanen, A. (2022). Investing Amid Low Expected Returns. Wiley. Retrieved from https://www.wiley.com/en-us/Investing+Amid+Low+Expected+Returns%3A+Making+the+Most+When+Markets+Offer+the+Least-p-9781119860198

- Ilmanen, A. (2021). “How do Factor Premia Vary Over Time? A Century of Evidence.” Journal of Investment Management, 19(2), 15-57. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3400998

- Ilmanen, A. (2011). Expected Returns: An Investor’s Guide to Harvesting Market Rewards. Wiley. Retrieved from https://onlinelibrary.wiley.com/doi/book/10.1002/9781118467190

- La Porta, R., Lakonishok, J., Shleifer, A., & Vishny, R. (1997). “Good News for Value Stocks: Further Evidence on Market Efficiency.” Journal of Finance, 52(2). Retrieved from https://www.jstor.org/stable/2329502

- Lev, B., & Srivastava, A. (2021). “Explaining the Recent Failure of Value Investing.” Retrieved from https://cfr.ivo-welch.info/forthcoming/papers/lev2021explaining.pdf

- Sloan, R. G., & Wang, A. Y. (2023). “Predictable EPS Growth and the Performance of Value Investing.” Review of Accounting Studies. Retrieved from https://link.springer.com/article/10.1007/s11142-023-09812-6

- Smart Beta ETF Shakeout in Europe Shows a Market Reaching Maturity. (n.d.). ETF Stream. Retrieved from https://www.etfstream.com/articles/smart-beta-etf-shakeout-in-europe-shows-a-market-reaching-maturity

- The Journal of Portfolio Management Vol 50 Issue 3 Quantitative Special Issue 2024. Portfolio Management Research. Retrieved from https://www.pm-research.com/content/iijpormgmt/50/3