We assert that market timing profoundly influences the entire architecture of investment strategies. It is structurally at odds with time horizon control—a topic we have recently examined. Yet, every investment must engage in trading to optimize various objectives, and no trade can be entirely independent of market timing considerations. Consequently, it is fundamentally and strategically impossible to dissociate time horizon control from the management of market timing. However, the policy framework governing market timing management often remains ambiguous.

Market timing is often perceived in investing as an alluring shortcut to superior returns, predicated on skillfully navigating market fluctuations. Many investors, particularly those driven by short-term gains, believe that success lies in consistently capitalizing on every market oscillation—continuously piecing them together and tweaking the portfolio’s risk-return profile to sub-optimize for a short-term horizon. However, this perspective fundamentally misconstrues the essence of long-term investing, where the time horizon—not specific market entry and exit points—is the paramount determinant of success. As discussed in our recent article, time horizon is not merely a detail but a foundational pillar that shapes portfolio construction, risk management, and ultimately the ability to deliver sustained value to clients over time.

For long-term fundamental investors like us, the focus is not on stitching together short-term returns, but on aligning each element of the investment process—from research and valuation to portfolio construction and asset allocation—around a long-term perspective. This emphasis on intrinsic value over time, rather than chasing short-term gains, allows us to optimize portfolio by coherently and carefully aligning elements of time horizon in the process and keeping a cool distance from the noisy sequences of intellectual herding forecasts and keeping smart investment mindfulness by embracing periods of underperformance as advanced payment of premium for unrealized claim for future return. The short-term volatility that many view as an obstacle becomes an ally to the long-term investor, providing opportunities to accumulate high-quality assets at discounted prices. In contrast to those who participate in the market’s bipolar fluctuations, continually reacting to extremes, we prefer to step back and take a broader view, focusing on long-term growth of intrinsic value rather than trying to time the market’s forecasts on forecasts.

Data-Driven Insights Within a Long-Term Framework

The critical distinction between short-term and long-term investing strategies lies in how we incorporate data and timing. While market timing, in theory, may seem useful, its application within a fundamental, long-term investment process is nuanced. As detailed in our previous blog, long-term is not merely the sum of short-term periods. Rather, it is a distinct process focused on compounding returns, strategic alignment, and risk mitigation over time. This is why we approach data-driven insights with great care. We do not follow quantitative models simply for the sake of short-term prediction, but instead, we leverage data augmentation to reinforce the long-term investment thesis and generate a unique edge in understanding market trends and asset valuation.

Recently, we conducted an in-depth analysis of margin loan activity and its implications for S&P 500 performance. Our exploration of margin loan reversals—significant shifts in investor leverage—shows that these events can indeed provide valuable insights into market sentiment, but their true value emerges only when applied within a long-term framework. The short-term impact of margin loan reversals on market returns, while statistically significant in some cases, only reinforces the importance of maintaining a long-term perspective, as we seek to identify broader trends in market behavior that align with sustainable value creation over time.

By integrating these data-driven tools, we aim to enhance our fundamental research process without deviating from the core philosophy of long-term investing. Market timing, when viewed through the lens of long-term horizons, becomes less about precise entry and exit points and more about positioning portfolios to benefit from structural shifts in market sentiment—capturing value not in the immediate aftermath of an event, but through sustained exposure to compounding growth over multiple periods.

Detailed Breakdown of the Analysis (Monthly Data: 1997–2024)

Objective:

This analysis was designed to delve deeper into margin loan behavior by using monthly data from 1997 to August 2024. The focus was on detrending the data to isolate short-term deviations and detect whether sharp margin loan reversals could statistically predict future S&P 500 returns.

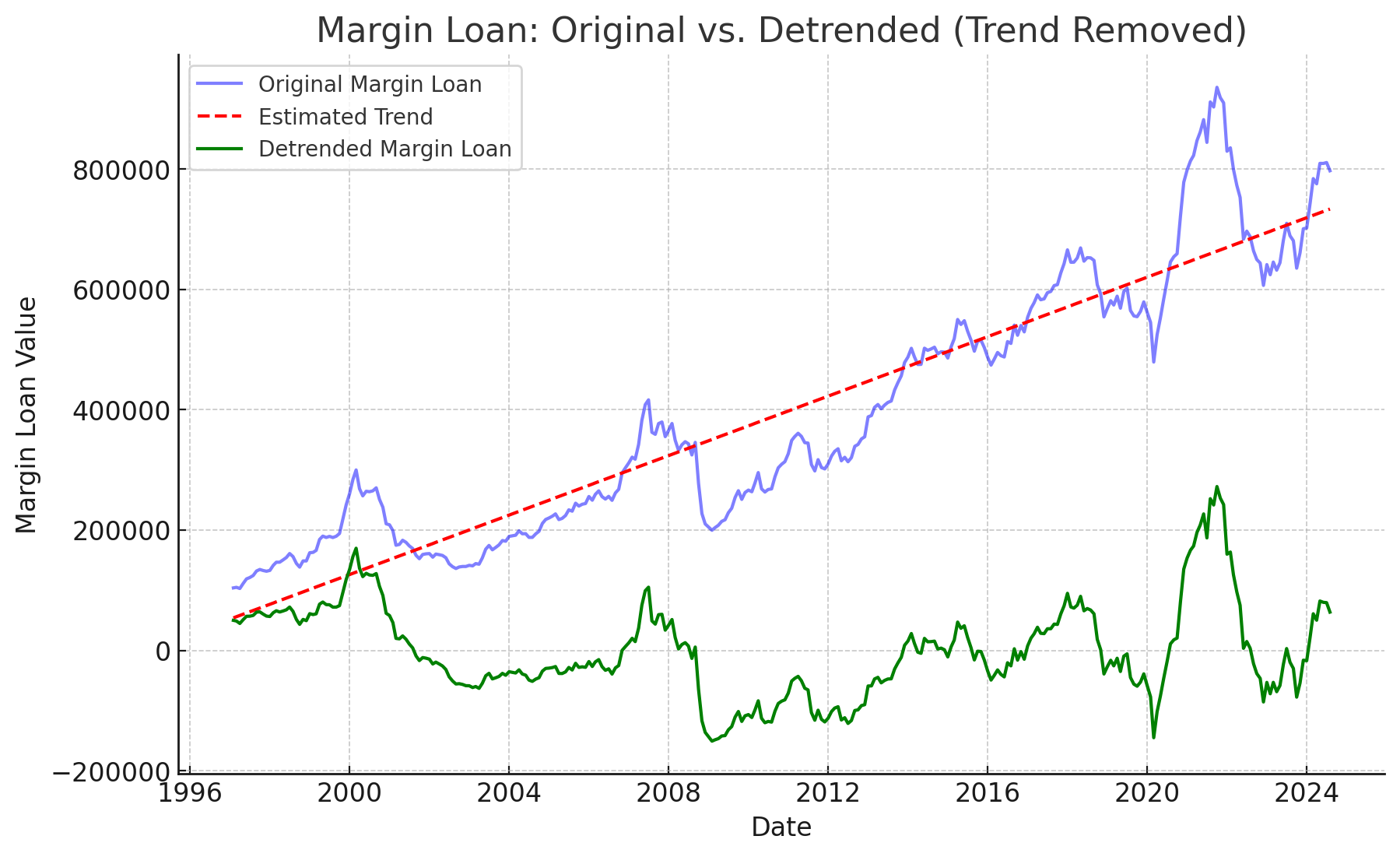

Detrending the Margin Loan Data:

- Why Detrend? Margin loans tend to have a natural upward trend over time due to long-term economic growth and rising asset prices. This trend could mask shorter-term fluctuations that are more indicative of changes in investor sentiment.

- Process: A linear regression model was applied to estimate the long-term trend in margin loans. This trend was then subtracted from the actual data, leaving a detrended margin loan deviation series that focuses on short-term changes rather than the long-term growth pattern.

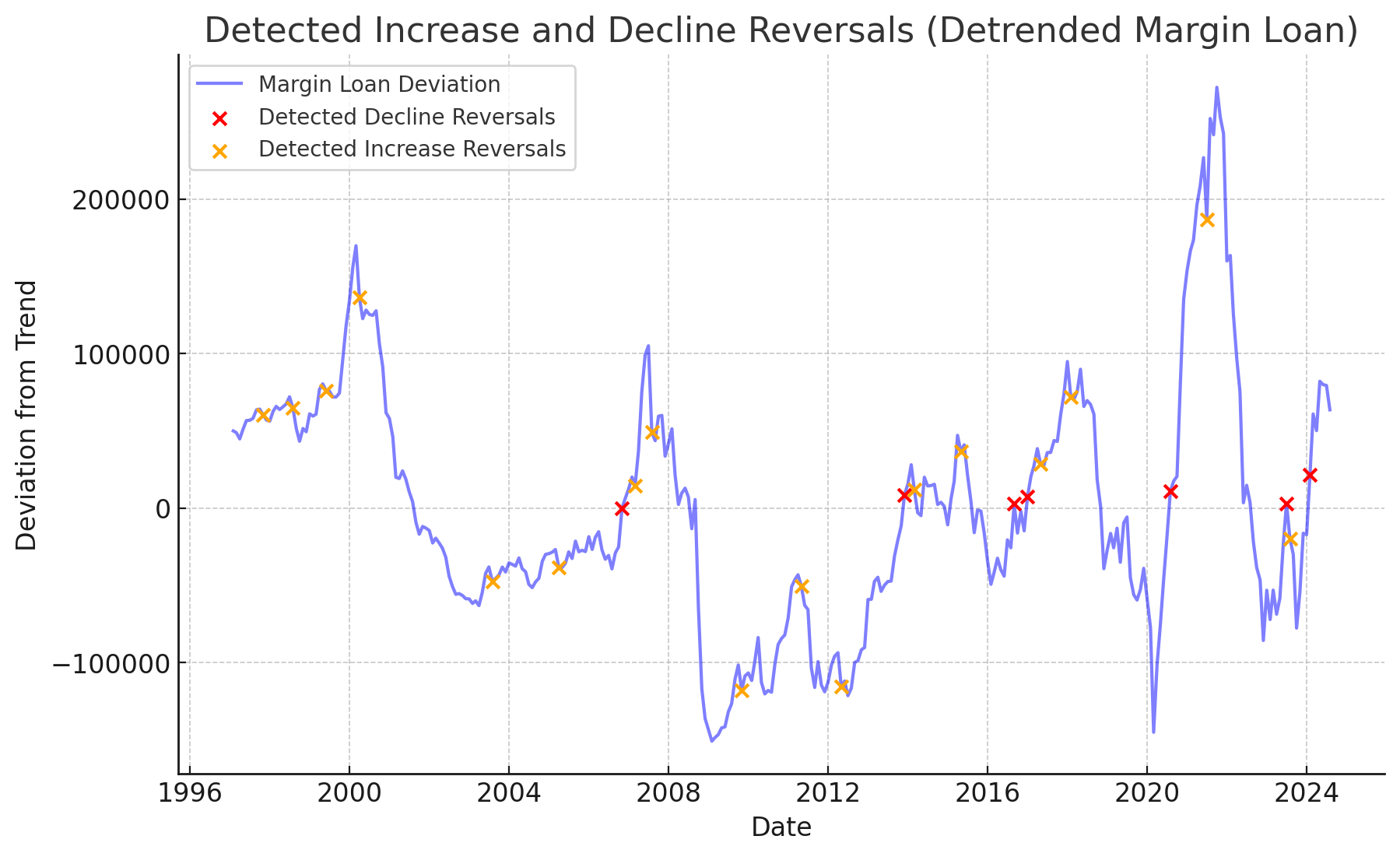

Reversal Detection:

Once the data was detrended, the analysis identified reversal events:

- Decline Reversal: Sharp increases in margin loans after consistent declines.

- Increase Reversal: Sharp declines in margin loans after consistent growth.

Optimal thresholds and look-back periods for detecting these reversals were determined via a grid search process, ensuring that the selected reversal events were robust and reflective of significant sentiment shifts.

The grid search on the detrended margin loan deviation series has identified the following optimal parameters for predicting S&P500 price movements:

- Threshold for sharp increase: 1.0% (percentage growth in margin loan deviation)

- Threshold for sharp decline: 1.0% (percentage decline in margin loan deviation)

- Lookback period: 3 months (to detect the reversal pattern)

- Lag period: 5 months (to measure the impact of the reversal on future S&P500 price changes)

The causality score is 3.11, which suggests a significant relationship between margin loan reversals (based on deviations from the trend) and S&P500 price movements.

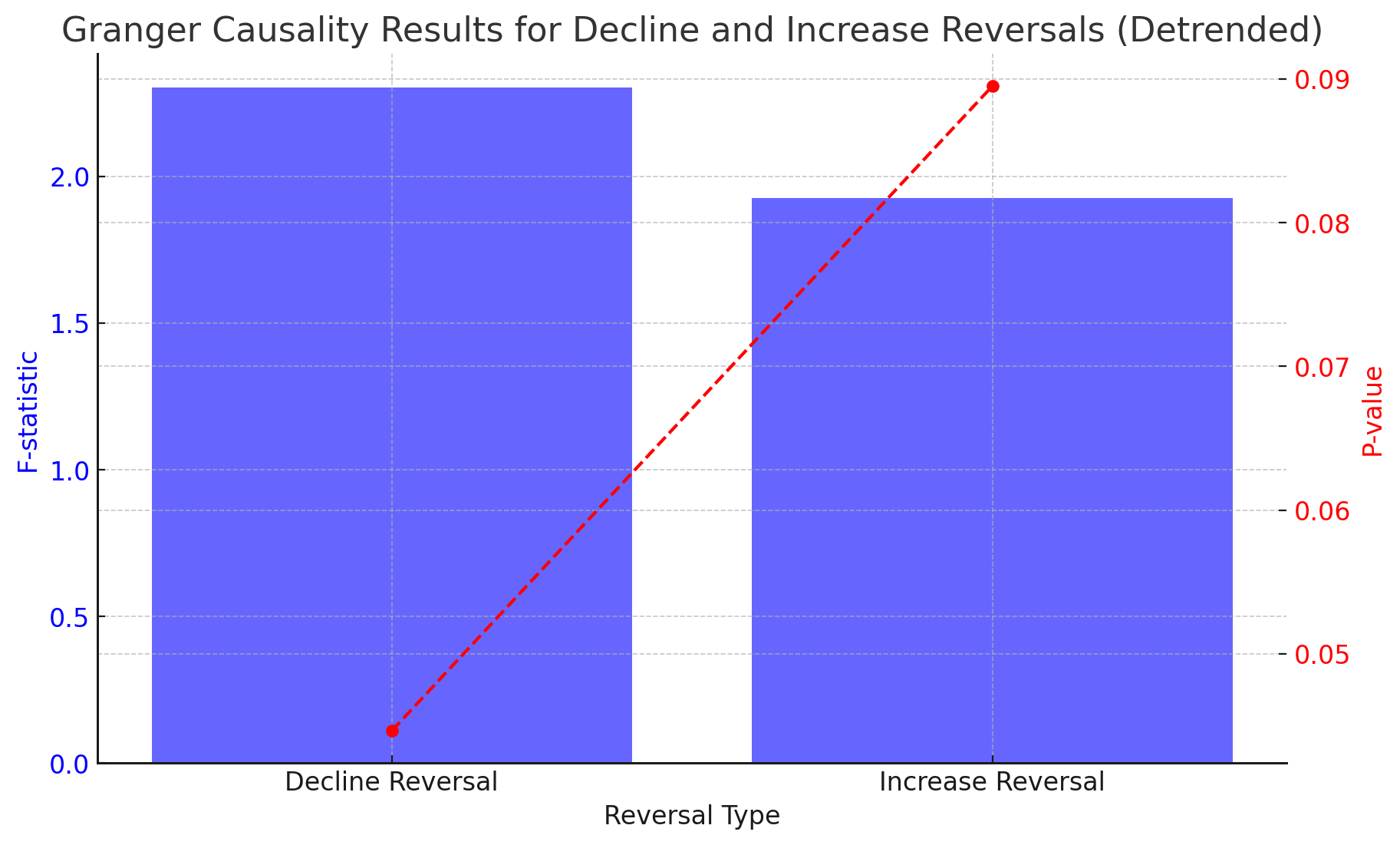

Granger Causality and Predictive Power:

Granger Causality Tests:

- These tests were conducted to examine whether margin loan reversals could predict future changes in S&P 500 returns, using a 3-month lookback window to detect the reversals and measuring their impact over a 5-month lag.

- Parameters: Reversals were tested to see if they could predict S&P 500 price changes with a lag of up to 5 months, meaning that the analysis was looking for medium-term effects rather than immediate reactions.

Results:

- Decline Reversals: These showed statistically significant causality with an F-statistic of 2.30 and a p-value of 0.0446, implying that increases in margin loans following declines have strong predictive power for future S&P 500 gains over the next 5 months.

- Increase Reversals: These reversals had weaker predictive power, with an F-statistic of 1.93 and a p-value of 0.0895, suggesting some predictive potential for market declines but not with the same confidence level.

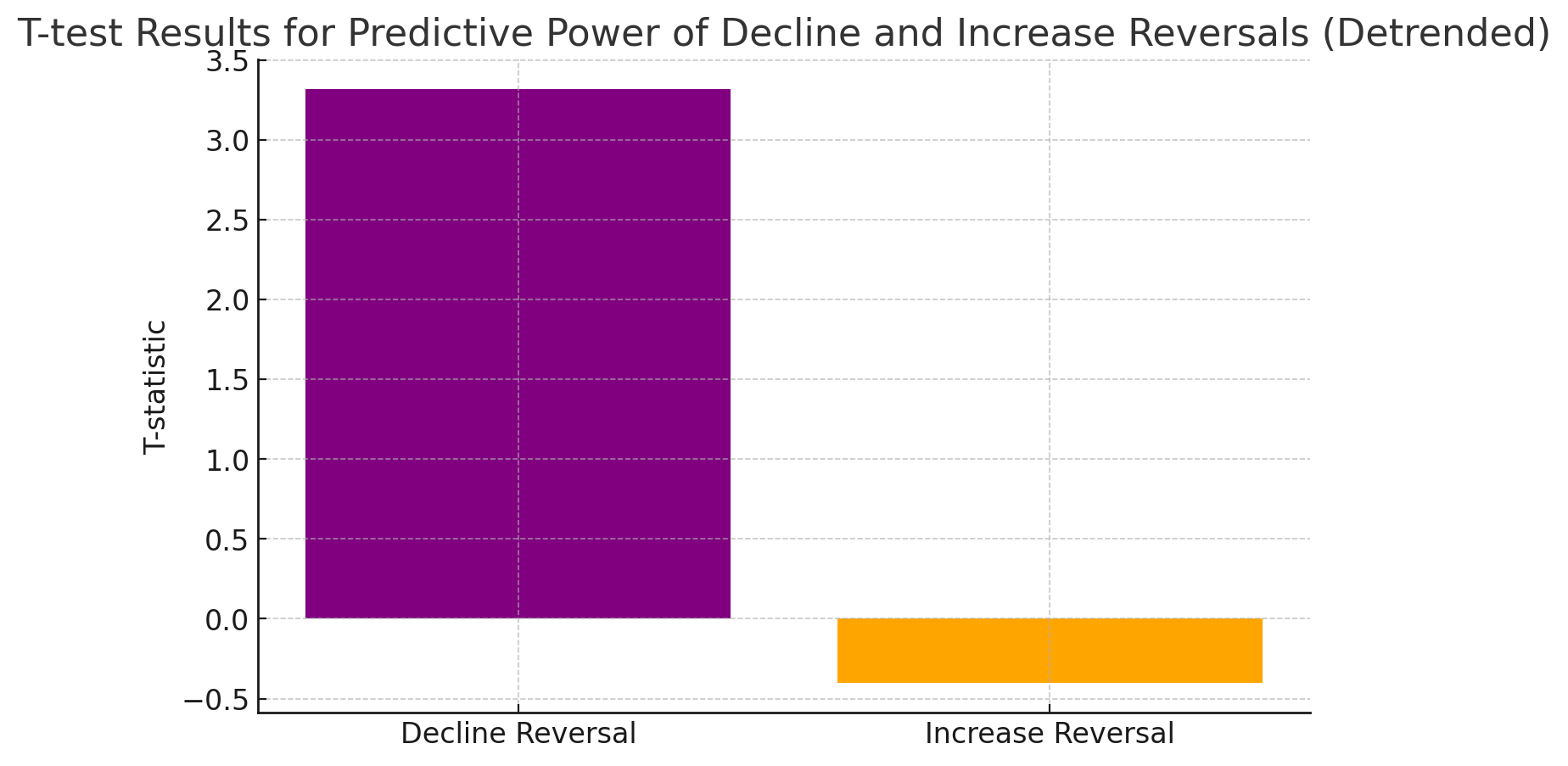

T-tests for Predictive Power:

- Null Hypothesis: The mean return following a reversal is zero, meaning that the reversal does not predict future returns.

- Alternative Hypothesis: The mean return following a reversal is significantly different from zero, indicating predictive power.

Results:

- Decline Reversals: These were found to be statistically significant with a t-statistic of 3.32 and a p-value of 0.0161. This shows that sharp increases in margin loans after declines are strong predictors of future positive returns, with a high degree of confidence.

- Increase Reversals: The t-test showed no significant predictive power for future negative returns (t-statistic = -0.40, p-value = 0.6926), reinforcing the idea that market declines following these reversals are more gradual and unpredictable.

Visualization and Interpretation of Key Findings:

- Trend vs. Detrended Margin Loan Series: The first visualization in the study highlights the importance of detrending the margin loan data. By focusing on the short-term deviations, the analysis isolates the more volatile, sentiment-driven shifts that are most likely to impact market returns.

- Reversal Detection (Increase and Decline): Red and orange markers on the graphs helped pinpoint where sharp shifts in margin loans occurred. These visually show how these reversals align with changes in market conditions.

- Granger Causality Results: Visualizations of the F-statistics and p-values from the Granger tests confirmed that decline reversals were much more powerful predictors of future market gains than increase reversals were for predicting market declines.

Deep Validation and Robustness:

The use of:

- T-tests for statistical significance of forward returns,

- Granger causality tests for detecting predictive relationships between margin loans and market returns, and

- Detrended analysis to focus on short-term fluctuations rather than long-term trends,

ensured that the results were robust and meaningful. These statistical tests allowed the researchers to validate their hypotheses with a high degree of confidence, ensuring that the findings were not simply due to chance or random market noise.

Data Driven Implications for Market Timing in the Long-Term Investors Context:

The statistical validation in both studies demonstrates the importance of recognizing patterns like decline reversals, which have consistently shown predictive power for future market gains. However, the results also caution against overreacting to increase reversals, where declines tend to be more gradual and less predictable. For long-term investors, these findings reinforce the value of patience, strategic portfolio positioning, and the use of volatility as an opportunity to accumulate undervalued assets. Moreover, market timing based on these reversals can be useful, but only within the broader context of a long-term strategy focused on intrinsic value and compounding growth.

It’s important to note that the impact of a reversal in increasing or decreasing prices will fade within a couple of quarters from the event. The persistence of a downward price trend depends heavily on time, indicating that the window of opportunity for market timing is limited. When weighing the potential cost of missing a market turn against decision accuracy and confidence within a specific timeframe, it is the highly professional judgment as an investment management business that plays a significant role. We believe there is a strong argument to support the idea that the best course of action for long-term investors is to keep distance from bias toward timing the market and also to focus on narrowing down investment options not just on static high quality with high market price at those points but also on dynamic value to the future with supporting floor value with familiar & sustainable foundation.

Market Timing in the Context of Long-Term Investing: Insights from Benjamin Graham and Warren Buffett

Market timing, the practice of trying to predict short-term market fluctuations to buy low and sell high, has long been a tempting strategy for investors seeking quick gains. However, both Benjamin Graham and Warren Buffett caution against this speculative approach, advocating instead for a focus on long-term value and intrinsic pricing. Their combined wisdom provides invaluable guidance for investors looking to build wealth over time rather than chase the fleeting rewards of market timing.

Benjamin Graham: Price Over Timing

Benjamin Graham’s critique of market timing is rooted in his belief that short-term market movements are largely unpredictable. He argues that investors should focus on buying assets at a price below their intrinsic value, rather than trying to time the market’s highs and lows. According to Graham, attempting to anticipate market cycles transforms investing into speculation, which is fraught with risk and often leads to poor outcomes.

Graham acknowledges that the market operates in cycles, with periods of boom and bust, but he emphasizes that these cycles are irregular and difficult to predict. He suggests that even when the market is at a low point, there is no guarantee that prices will immediately rebound. Instead, the intelligent investor should focus on price, not timing, buying when prices are attractive relative to the value of the business, regardless of broader market conditions.

Formula Timing and Dollar-Cost Averaging

While Graham rejects speculative market timing, he does see value in systematic approaches like formula timing and dollar-cost averaging. These methods compel investors to buy and sell based on predetermined price levels, which removes emotional decision-making from the process. By investing consistently over time, particularly during market downturns, investors can accumulate more shares at lower prices, benefiting from market volatility rather than fearing it.

Warren Buffett: The Cost of Waiting for Certainty

Warren Buffett builds on Graham’s principles by highlighting the opportunity cost of waiting for perfect market conditions. In his 1979 Forbes article, “You Pay a Very High Price in the Stock Market for a Cheery Consensus”, Buffett critiques the tendency of investors to sit on the sidelines, waiting for signs that the market has stabilized. He warns that by the time the market feels “safe,” prices will have already risen, and the best opportunities will have passed.

Buffett underscores the point that uncertainty is actually the friend of the long-term investor. We view it in the same way and stress that risk premium paid or owned today as short-term volatility is a prepaid booster for future return, and what matters is the quality of risk premium. When market conditions are uncertain, stocks are often undervalued, presenting an ideal buying opportunity for those with a long-term perspective. He encourages investors to buy when others are fearful and to avoid the herd mentality that drives many to sell during downturns and buy during rallies.

Market Timing: Psychological Pitfalls

Both Graham and Buffett emphasize the psychological traps that come with market timing. Graham notes that many investors panic during market downturns, abandoning long-term strategies in favor of short-term protection. Buffett extends this idea, pointing out that professional investors, like pension fund managers, often make decisions based on past performance rather than future potential, leading them to avoid stocks when they are cheap and buy when they are expensive. While we think these have not changed since the days of Keynes or Tulipmaia, so it will stay forever into future. We think every investor needs to embrace investment mindfulness and train his/her own mind to keep a cool distance from the bustle of the market noise from a bird’s eye view position.

The key takeaway from both is that market timing often leads to missed opportunities. We showed this through the presenting research indicating a very narrow actionable window requiring timely and difficult judgment even for the best managers during uncertainty. Rather than trying to outsmart the market’s short-term movements, investors should focus on long-term value creation, buying when prices are attractive and holding through periods of volatility.

Volatility as Opportunity

For both Graham and Buffett, volatility is not something to fear, but an opportunity to exploit. Graham views volatility as temporary noise that can be ignored in the pursuit of long-term gains. Buffett goes further, arguing that volatility presents the best opportunities to buy undervalued assets, provided the investor has the patience and discipline to wait for their value to be realized over time.

Conclusion: Rejecting Market Timing for Long-Term Success

Graham and Buffett’s shared wisdom on market timing provides a clear directive: focus on value, not timing. Market fluctuations are inevitable, but trying to predict them is a fool’s errand. Instead, by concentrating on intrinsic value, maintaining discipline during volatile periods, and avoiding the temptation to follow the crowd, long-term investors can harness the power of compounding and build sustainable wealth over time.

Both emphasize that the best opportunities arise during periods of uncertainty, and those who wait for the market to feel safe often pay a high price in missed opportunities. For long-term investors, the key to success lies in resisting short-term speculation, embracing volatility, and maintaining a steady focus on value.

Conclusion: The Timeless Wisdom of Graham and Buffett on Market Timing

The wisdom of Benjamin Graham and Warren Buffett underscores the importance of focusing on value, not market timing. Their insights are directly applicable to the findings from our margin loan analysis, which emphasizes that margin loan reversals—particularly Decrease-then-Increase reversals—provide long-term investors with valuable signals for increasing market exposure. Rather than succumbing to the emotional temptations of short-term market timing, investors should maintain a disciplined approach, focusing on price and value, and using volatility as an opportunity rather than a threat.

For long-term investors, these lessons are critical for navigating market cycles and ensuring sustained, compounding growth over time. The data-driven insights combined with solid, intensive, exhaustive, and extensive fundamental research, aligned with the timeless principles of Graham and Buffett, offer a robust framework for building and maintaining long-term wealth.

References

- Data Source: FINRA Margin Statistics

- Research References:

- Fortune, P. Margin Requirements and Stock Market Volatility, Federal Reserve Bank of Boston.

- Deuskar, P., Kumar, N., Poland, J. A. Margin Credit and Stock Return Predictability, NYU Stern School of Business.

- Kupiec, P. Margin Requirements, Volatility, and Market Integrity.

- “Timing Considerations in Investment Policy” Benjamin Graham, Security Analysis 1951 Edition

- “You Pay A Very High Price in The Stock Market for A Cherry Consensus” Warren E.Buffett