Intrinsic Insights:

Articles | BALASTONEUnconventionally Faithful to the Principle of Investment

At BALANSTONE, we ensure process by merging data-driven insights with a steadfast commitment to intrinsic value philosophy. Our unique approach uses rigorous, long-term research grounded in both advanced data analytics and timeless investment principles. This blend enables us to take a strategy through a long investment journey under evolving landscapes.

Our research explores diverse investment topics, from historical principles and empirical lessons to the latest trends, all analyzed through a data-driven lens. By focusing on intrinsic value and rigorous fundamental analysis, we spot undervalued assets and pursue growth opportunities with patience and precision.

Warren Buffett and IBM

I have been bearish toward IBM for years. However, throughout 2016, Berkshire Hathaway kept remaining as the largest shareholder of IBM. I have a deep respect for Warren Buffet (as I touched on high conviction investing in this article) and IBM is...

What Is Driving The Stock Market

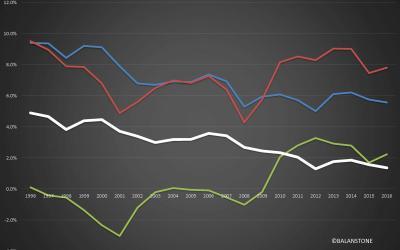

We share our perspectives and present five long term historical charts including return on invested capital using Russell 3000, which is made of 3000 large US companies, as determined by market capitalization. This portfolio of securities represents approximately 98%...

Investment Style and Composition of Total Return

Investment style started to get attention in the mid-90s, and it was used to classify managers' bias by the groups of type of strategic focus. The typical styles include "value vs. growth", "domestic vs. international", and "large-cap vs. small-mid cap". Since then,...

Apple Valuation | Valuing an Excess Cash Company

When dealing with a company valuation with excess cash, what steps to take first? First, you need to make a split. Apple valuation is a very good sample and it can be done in a simple manner. I split Apple into Cash Apple and Operating Apple as follows. Assuming...

What Causes Inflation

Why do we, the investment professionals, ask what causes inflation and need to get equipped with an accurate idea of the long-term trend of inflation? As the decline in the cost of capital has had a strong influence on the discount rate for future excess return, the...

Japan Economy According to Krugman

Krugman provided his proposal on the problem of Japan economy back in 1998, which centered on the liquidity trap and inflation expectation. It recommended using monetary policy aggressively to boost inflation expectation to get it out of the liquidity trap (where the...